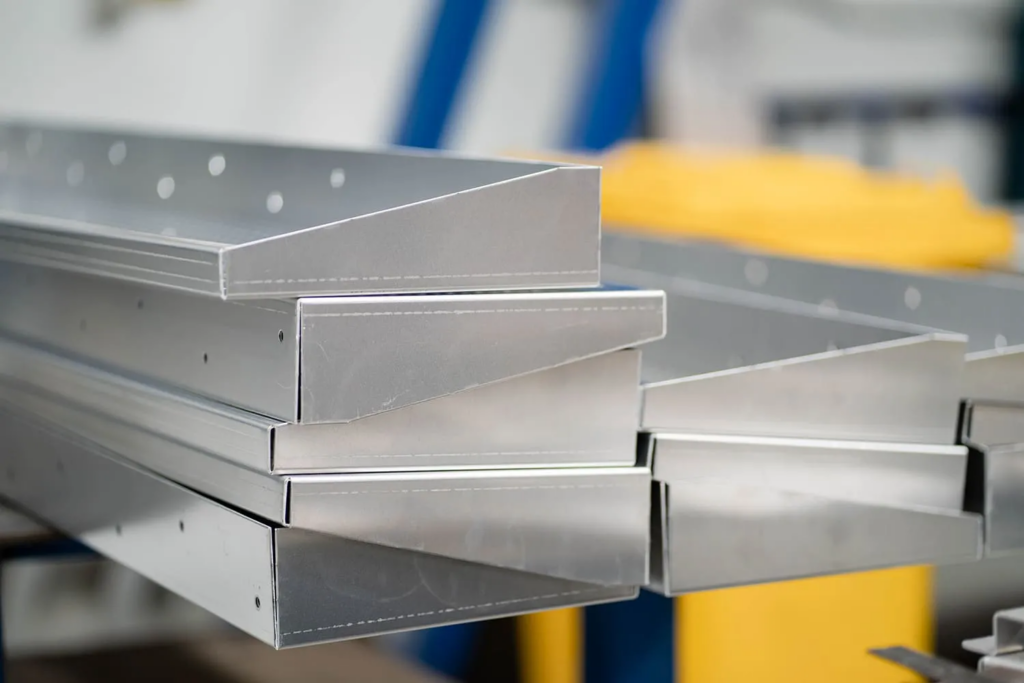

As we move into 2025, the aluminium market is experiencing significant shifts that are expected to drive prices upward. A combination of supply chain disruptions, energy crises, geopolitical tensions, and increased demand from key sectors is contributing to a global shortage of aluminium. This shortage is anticipated to bolster prices, impacting various industries that rely on this versatile metal.

Understanding the Factors Behind Aluminium’s Price Increase

The COVID-19 pandemic has had a lasting impact on global supply chains, including the aluminium industry. Factory shutdowns and slowed production in key aluminium-producing countries have led to a reduced supply of aluminium in international markets. For instance, in China, strict environmental regulations aimed at reducing pollution have further limited production. As industries recover and demand surges, the supply has struggled to keep pace, contributing to rising prices.

Energy Crisis Impact

Aluminium production is highly energy-intensive, requiring substantial electricity. Recent energy crises in Europe and parts of Asia have led to increased energy prices, causing many aluminium smelters to scale back operations or temporarily shut down. This reduction in production capacity, coupled with climbing demand, is exerting upward pressure on aluminium prices.

Geopolitical Factors

Geopolitical tensions significantly influence the global aluminium supply. Trade restrictions, tariffs, and sanctions disrupt the smooth flow of aluminium between countries. For example, the ongoing trade conflict between the US and China has resulted in aluminium tariffs that raise the cost of imports. Additionally, conflicts such as the war in Ukraine create uncertainties in European markets, further exacerbating the shortage and contributing to price increases.

Increased Demand from Key Sectors

Aluminium is essential across various industries, including construction, automotive manufacturing, and aerospace. The rapid growth of electric vehicles (EVs) has driven up demand for aluminium, as these vehicles require lightweight materials to improve energy efficiency. Similarly, the construction sector has seen a surge in demand for aluminium, used extensively in infrastructure projects. With more industries relying on aluminium, global demand continues to grow, intensifying the pressure on supply and driving prices higher.

Strategies to Mitigate the Impact of Rising Aluminium Prices

Given the anticipated increase in aluminium prices, businesses and consumers can adopt several strategies to mitigate the impact:

Diversify Material Usage

Exploring alternative materials can reduce dependence on aluminium. For instance, in manufacturing, substituting aluminium with materials like steel or composites where feasible can help manage costs. However, it’s essential to consider the properties required for specific applications to ensure that alternatives meet necessary performance standards.

Improve Efficiency and Reduce Waste

Enhancing production efficiency and minimising waste can offset increased material costs. Implementing lean manufacturing principles and investing in technology to optimise processes can lead to significant savings. Additionally, recycling aluminium scrap within production can reduce the need for new aluminium, mitigating the impact of rising prices.

Long-Term Contracts and Hedging

Engaging in long-term contracts with suppliers can lock in current prices and provide protection against future increases. Additionally, financial instruments such as futures contracts can be used to hedge against price volatility. These strategies require careful planning and consultation with financial experts to ensure they align with business objectives.

Monitor Market Trends and Stay Informed

Keeping abreast of market trends and forecasts allows businesses to make informed decisions. Regularly reviewing industry reports and economic indicators can provide insights into price movements and help in strategic planning. Staying informed enables businesses to anticipate changes and adapt proactively, rather than reacting to market pressures.

The Role of Government and Industry Collaboration

Addressing the challenges posed by rising aluminium prices requires collaboration between government and industry stakeholders. Investments in infrastructure, energy efficiency, and sustainable practices can enhance production capabilities and stabilise supply. For example, the Australian Aluminium Council has been actively engaging with the government to discuss industry priorities and support a stronger, more sustainable aluminium industry in Australia.

Encouraging Recycling and Circular Economy Practices

Promoting recycling and the circular economy can significantly reduce the reliance on primary aluminium production. Encouraging the reuse and recycling of aluminium products can alleviate pressure on raw material supply and help stabilise prices. Policies that incentivise recycling and penalise wasteful practices can drive industries towards more sustainable practices.

Supporting Research and Development

Investing in research and development (R&D) can lead to innovative solutions that reduce reliance on traditional aluminium sources. Developing new alloys, improving smelting techniques, and finding efficient ways to use recycled materials can make the industry more resilient to price fluctuations. Government grants and industry partnerships can foster an environment where innovation thrives, ultimately benefiting the aluminium sector.

Conclusion

The anticipated rise in aluminium prices in 2025 presents challenges for industries and consumers alike. By understanding the contributing factors and implementing strategic measures, businesses can mitigate the impact and navigate this period of volatility. Diversifying material usage, improving efficiency, engaging in long-term contracts, and staying informed are practical steps to manage costs.

Additionally, collaboration between government and industry can play a crucial role in addressing the underlying issues and ensuring a stable aluminium supply for the future. Embracing recycling, encouraging innovation, and investing in sustainable practices are essential for long-term stability in the aluminium market.