The Reserve Bank of Australia’s (RBA) recent decision to cut the official cash rate carries substantial implications for everyday Australians, influencing everything from mortgage repayments to savings account interest. Understanding these changes is crucial for individuals and families navigating the evolving financial landscape.

Understanding the RBA’s Rate Cut

The RBA’s role involves setting the nation’s monetary policy, primarily through adjustments to the cash rate—the interest rate on overnight loans in the money market. By lowering this rate, the RBA aims to stimulate economic activity, encouraging spending and investment. The February 2025 reduction of 25 basis points brought the cash rate down to 4.10%, marking the first cut since November 2020.

Immediate Benefits for Mortgage Holders

For many Australians, the most tangible impact of the rate cut is on home loan repayments. Borrowers with variable-rate mortgages will likely see a decrease in their interest rates, leading to lower monthly payments. For instance, on a $600,000 loan, a 0.25% rate reduction translates to approximately $92 in monthly savings. Over a year, this amounts to over $1,100—funds that can be redirected towards savings, investments, or daily expenses.

Increased Borrowing Capacity

Lower interest rates also enhance borrowing capacity. Financial institutions often adjust their lending criteria in response to rate cuts, potentially allowing borrowers to access larger loan amounts. This can be particularly advantageous for those looking to enter the property market or upgrade their current homes. However, it’s essential to approach increased borrowing with caution, ensuring that repayments remain manageable even if rates rise in the future.

Impact on Savings and Term Deposits

While borrowers may welcome lower interest rates, savers could experience reduced returns on their deposits. Major banks have already announced cuts to savings account and term deposit rates. For example, Commonwealth Bank decreased its term deposit rates by 0.10%, with the highest rate now at 4.50% for a 10-month term. This adjustment means that individuals relying on interest income may need to reassess their savings strategies to maintain their financial goals.

Effects on the Housing Market

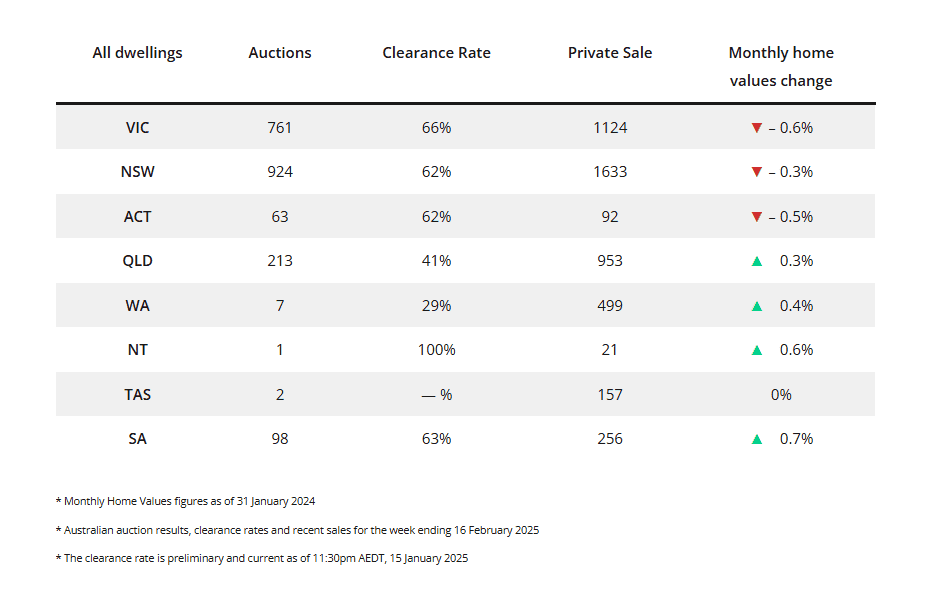

The rate cut is expected to influence the housing market dynamics significantly. Lower borrowing costs can lead to increased demand for properties, potentially driving up prices, especially in high-demand areas like Sydney and Melbourne. This scenario benefits existing homeowners through increased property values but may pose challenges for prospective buyers facing heightened competition and rising prices.

Investor Activity and Market Competition

Reduced interest rates often attract investors back into the property market, seeking to capitalise on lower borrowing costs and potentially higher rental yields. This resurgence can intensify competition, making it more difficult for first-home buyers to secure properties. In markets like Brisbane, increased investor activity has already contributed to steady rises in median house prices, further straining affordability.

Challenges for First-Time Homebuyers

First-time buyers may find the current environment challenging. While lower interest rates improve borrowing capacity, the accompanying rise in property prices and increased competition from investors can offset these benefits. Additionally, limited housing supply exacerbates the situation, making it crucial for prospective buyers to be well-prepared, financially disciplined, and ready to act swiftly when opportunities arise.

Broader Economic Implications

Beyond the housing market, the rate cut has broader economic ramifications. By reducing the cost of borrowing, the RBA aims to stimulate consumer spending and business investment, fostering economic growth. However, there’s a delicate balance to maintain. Excessive stimulation can lead to inflationary pressures, while insufficient action may result in sluggish economic performance. The RBA’s decision reflects its assessment of current economic conditions, including factors like inflation trends, employment rates, and global economic uncertainties.

Government Measures and Fiscal Policy

In conjunction with monetary policy adjustments, government fiscal measures play a critical role in shaping economic outcomes. Recent budget allocations include cost-of-living measures such as tax cuts, extended energy rebates, and reduced medicine prices. While these initiatives aim to provide relief to households, they also contribute to increased government expenditure, which can influence inflation and interest rate trajectories. It’s essential for policymakers to coordinate monetary and fiscal strategies to achieve sustainable economic growth without exacerbating inflationary concerns.

Preparing for Future Rate Movements

While the current rate cut offers immediate benefits, it’s important to recognise that interest rates are cyclical and can rise in the future. Borrowers should consider strategies to manage potential rate increases, such as fixing a portion of their mortgage, building financial buffers, or accelerating repayment schedules. Staying informed about economic trends and maintaining flexibility in financial planning can help mitigate the impact of future rate changes.

Conclusion

The RBA’s recent rate cut offers relief to mortgage holders and stimulates economic activity. It also presents challenges for savers and prospective homebuyers.

Understanding these dynamics enables individuals to make informed financial decisions, adapting strategies to navigate the evolving economic landscape effectively. As always, seeking professional financial advice tailored to personal circumstances is advisable to optimise outcomes in this changing environment.